You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tech Thread

- Thread starter MindzEye

- Start date

MindzEye

Wayward Ditch Pig

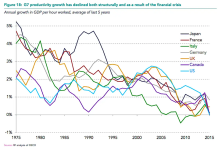

I think that's part of it but imo the larger part is that company's don't really invest profits into innovation anymore. S&P 500 companies have totalled about 2.8 Trillion dollars in stock buy backs from 2022-2024. That's 2.8 Trillion in profits removed from the companies and given to the ownership class, who buy more assets with that money. Worker productivity comes from actual investment in technology, training, process, etc.

A company like Intel is a spectacular example. Biggest CPU manufacturer in the world for a generation, should be a multi Trillion dollar company right now. Sat back on it's market dominance and did nothing with it but buy back stock. Cut R&D budgets, shredded it's organizational knowledge on how to build good product (don't know if you follow the tech industry at all, but their 13th & 14th gen processors are beyond a disaster and they've lost huge market share to AMD and others). But between 2014 and 2021 they did buyback 64 billion worth of stock.

A company like Intel is a spectacular example. Biggest CPU manufacturer in the world for a generation, should be a multi Trillion dollar company right now. Sat back on it's market dominance and did nothing with it but buy back stock. Cut R&D budgets, shredded it's organizational knowledge on how to build good product (don't know if you follow the tech industry at all, but their 13th & 14th gen processors are beyond a disaster and they've lost huge market share to AMD and others). But between 2014 and 2021 they did buyback 64 billion worth of stock.

Aberdeen

Well-known member

Definitely - there's lots in there beyond technologies failed promise.I think that's part of it but imo the larger part is that company's don't really invest profits into innovation anymore. S&P 500 companies have totalled about 2.8 Trillion dollars in stock buy backs from 2022-2024. That's 2.8 Trillion in profits removed from the companies and given to the ownership class, who buy more assets with that money. Worker productivity comes from actual investment in technology, training, process, etc.

A company like Intel is a spectacular example. Biggest CPU manufacturer in the world for a generation, should be a multi Trillion dollar company right now. Sat back on it's market dominance and did nothing with it but buy back stock. Cut R&D budgets, shredded it's organizational knowledge on how to build good product (don't know if you follow the tech industry at all, but their 13th & 14th gen processors are beyond a disaster and they've lost huge market share to AMD and others). But between 2014 and 2021 they did buyback 64 billion worth of stock.

In my engineering days used to watch the old timey engineers, head.down marking up blueprints, looking things up in dusty old books. Us "kids" would tip tap away on our computers, respond to all our emails and run simulations to help size our equipment feeling smug. But in aggregate when you add it all up I'd bet dollars to donuts that those dinosaurs were more productive than us...and made fewer errors to boot.

MindzEye

Wayward Ditch Pig

Definitely - there's lots in there beyond technologies failed promise.

In my engineering days used to watch the old timey engineers, head.down marking up blueprints, looking things up in dusty old books. Us "kids" would tip tap away on our computers, respond to all our emails and run simulations to help size our equipment feeling smug. But in aggregate when you add it all up I'd bet dollars to donuts that those dinosaurs were more productive than us...and made fewer errors to boot.

A lot of "productivity improvements" that companies focus on is how to design process in such a way that irreplaceable employees aren't actually irreplaceable. From a management standpoint, it makes more sense to do something 10% slower and worse, but replicable by anyone so that it takes 1 year to get someone up to speed on in house process rather that 5-10 years for actual subject mastery to develop by doing it the right way.

Aberdeen

Well-known member

I get it....but I don't have to like it!A lot of "productivity improvements" that companies focus on is how to design process in such a way that irreplaceable employees aren't actually irreplaceable. From a management standpoint, it makes more sense to do something 10% slower and worse, but replicable by anyone so that it takes 1 year to get someone up to speed on in house process rather that 5-10 years for actual subject mastery to develop by doing it the right way.

CH1

The Artist Formerly Known as chiggins.

I think that's part of it but imo the larger part is that company's don't really invest profits into innovation anymore. S&P 500 companies have totalled about 2.8 Trillion dollars in stock buy backs from 2022-2024. That's 2.8 Trillion in profits removed from the companies and given to the ownership class, who buy more assets with that money. Worker productivity comes from actual investment in technology, training, process, etc.

A company like Intel is a spectacular example. Biggest CPU manufacturer in the world for a generation, should be a multi Trillion dollar company right now. Sat back on it's market dominance and did nothing with it but buy back stock. Cut R&D budgets, shredded it's organizational knowledge on how to build good product (don't know if you follow the tech industry at all, but their 13th & 14th gen processors are beyond a disaster and they've lost huge market share to AMD and others). But between 2014 and 2021 they did buyback 64 billion worth of stock.

That’s the thing with AI — love it or hate it — it is a big investment in innovation.

MindzEye

Wayward Ditch Pig

Yep. I think it's a philosophical misunderstanding of what is both useful technology, and useful innovation, but it's definitely a big investment in innovation. Big brain post capitalism thinking at work....what if we had the economy...but without workers and the wealthy class owned literally everything?

brb, innovating on French gravitationally assisted cutting technology.

brb, innovating on French gravitationally assisted cutting technology.

MindzEye

Wayward Ditch Pig

Innovation!

techcrunch.com

techcrunch.com

DuckDuckGo now lets you hide AI-generated images in search results | TechCrunch

DuckDuckGo's new search feature comes as the internet is being flooded with AI-generated slop.

axlsalinger

Well-known member

MindzEye

Wayward Ditch Pig

People Are Being Involuntarily Committed, Jailed After Spiraling Into "ChatGPT Psychosis"

As we reported earlier this month, many ChatGPT users are developing all-consuming obsessions with the chatbot, spiraling into severe mental health crises characterized by paranoia, delusions, and breaks with reality. The consequences can be dire. As we heard from spouses, friends, children, and...

CH1

The Artist Formerly Known as chiggins.

CH1

The Artist Formerly Known as chiggins.

Also you can bet on this, just like @Preston !

View: https://x.com/deitaone/status/1946299643865838054?s=46&t=ZFoeJpONFeL00lgZvCrr2Q

View: https://x.com/deitaone/status/1946299643865838054?s=46&t=ZFoeJpONFeL00lgZvCrr2Q

axlsalinger

Well-known member

axlsalinger

Well-known member

axlsalinger

Well-known member

Wayward DP

Well-known member

Has always been a self-driving fairy taleTeslas marker cap may be as laughable. Dwarfing ford and gm on less than half the revenue.

Cal Gal

Well-known member

Court rules Mississippi's social media age verification law can go into effect

Court rules Mississippi's social media age verification law can go into effect

A Mississippi law that requires social media users to verify their ages can go into effect, a federal court has ruled. A tech industry group has pledged to continue challenging the law, arguing it infringes on users’ rights to privacy and free expression. A three-judge panel of the 5th Circuit...