then for four years you will be the Willardite right wing reactionary self loathing narcissist fighting off the progressive thinking centrists

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

OT: American Politics

- Thread starter MindzEye

- Start date

Worst thing that could happen in US is for the progressive President to win the electoral college as it looks like he will/should but lose in popular vote. Hannity, Beck, Limbaugh et al will never shut up about it.

theREALkoreaboy

New member

i am so into your guys' heads, its sick.

theREALkoreaboy

New member

Worst thing that could happen in US is for the progressive President to win the electoral college as it looks like he will/should but lose in popular vote. Hannity, Beck, Limbaugh et al will never shut up about it.

i'll tell you right now. if hopeychange wins the electoral college but loses the popular vote, you won't hear a peep out of me. i'm not gonna be like sore-loserman in 2000. its ratty.

Well isn't this a kick in the teeth.

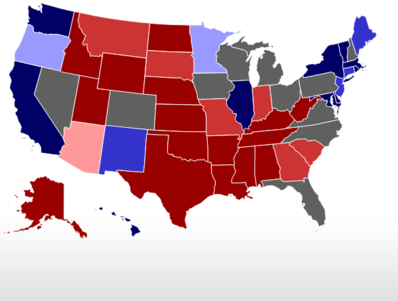

http://www.realclearpolitics.com/ep...tions_electoral_college_map_race_changes.html

Just when Obama was annihilating Romney.

but he is ahead in most of those "toss up" states so the election is still his to lose

theREALkoreaboy

New member

theyre pretty much all within the margin of error. this election is a toss-up.

He's ahead on the RCP average in Michigan and Penn by 5 points.

Re: OT: Canadian Politics

It's a majority, why waste time debating every piece of crap bill.

Suck it

Signed Corksens

It's a majority, why waste time debating every piece of crap bill.

Suck it

Signed Corksens

lecoqsportif

Well-known member

If you want to talk reality another 4 years of Obama won't work. Simply because the GOP won't work with him. The government has atrophied. They can't even pass a budget, three years without one.

Yeah, it's all Obama's fault. The GOP should not be held accountable, especially a fine, nuanced leader like Mitch McConnell.

I'm also confident they won't explode the deficit in a period of strong growth, destroy health care, entrench oligarchich fiscal policies, or start another oil war.

Habsy

Not playing around anymore.

but he is ahead in most of those "toss up" states so the election is still his to lose

He was ahead much further.

Habsy

Not playing around anymore.

Yeah, it's all Obama's fault. The GOP should not be held accountable, especially a fine, nuanced leader like Mitch McConnell.

I'm also confident they won't explode the deficit in a period of strong growth, destroy health care, entrench oligarchich fiscal policies, or start another oil war.

Yeah because that's what I said. Obama has his fair share of blame and then some.

Habsy

Not playing around anymore.

then for four years you will be the Willardite right wing reactionary self loathing narcissist fighting off the progressive thinking centrists

All that would happen is this thread would flip. All the liberals would condemn every single action Romney did and KB would defend them.

lecoqsportif

Well-known member

Actually, Clinton's health care plan failed because they did not reach across the isle. After that, he was basically a light-right triangulating DNC suit getting BJs in the Oval Office.

Anyway, McConnell said right from the get go that there would be no cooperation, so, it was rammed down their throats. They had it coming. I'm disappointed Obama didn't ram more shit through them.

Anyway, McConnell said right from the get go that there would be no cooperation, so, it was rammed down their throats. They had it coming. I'm disappointed Obama didn't ram more shit through them.

Last edited:

Habsy

Not playing around anymore.

Perhaps you missed the part where I said the GOP won't let Obama do anything so voting for him will mean four years of the same shit, small growth and high unemployment.

Also, "they had it coming"? Who? The citizens they ****ed? You, and the parties, forget who it is they're supposed to be representing.

Also, "they had it coming"? Who? The citizens they ****ed? You, and the parties, forget who it is they're supposed to be representing.

lecoqsportif

Well-known member

Let me get this straight. One party basically takes its toys and goes home, offering zero cooperation. Gridlock.

So, the best practical option (i.e. not voting for a third party) is to vote for the candidate of grumpy party, despite his economic policies that are vacuous fantasies and a foreign policy centered on maintaining a creaking oil empire and Kristian end-of-time rabble-rousing.

Gotcha. Makes sense to me!

So, the best practical option (i.e. not voting for a third party) is to vote for the candidate of grumpy party, despite his economic policies that are vacuous fantasies and a foreign policy centered on maintaining a creaking oil empire and Kristian end-of-time rabble-rousing.

Gotcha. Makes sense to me!

Montana

Champion

Do Tax Cuts Stimulate the Economy?

It seems self-evident that tax-cuts should stimulate the economy. It seems so self-evident, that we discuss the theory as if it were a known fact. We don't even question the claim. But history offers us some evidence that tax cuts don't stimulate the economy.

In 1921 & 1925, major taxes cut were passed. In the following years a stock market bubble formed while working class wages stagnated, then in 1929 the bubble burst and the economy crashed into the Great Depression.

- In 1981 a tax cut was passed. The economy sank deeper into recession and stayed in recession for nearly two years.

- In 1987 major tax cuts were passed. By 1990 growth declined leading into the 1991 recession.

- In 2001 a tax cut was passed, and another rebate was given in 2008. From 2001 through 2008 the economy grew slower than it did in the preceding 8 while a bubble formed in stocks, housing, and executive salaries. In 2008 the bubble burst, and now the economy in sinking into the worst recession since the Great Depression.

So what do we see in the data overall? Perhaps we should look at the data more thoroughly. We start by looking at the marginal tax rate on the richest citizens.

When we look at the tax rate charged to the richest citizens, we see that low taxes correlate to slow growth. When marginal taxes on the rich were below 40% growth remained below 4.5%. When top taxes were above 65% growth tended to be higher, even going above 6%. Historically, higher taxes on the rich have correlated to higher growth.

Making the comparison:

--------------------------- Max Tax below 40%------Max Tax above 65%

Average Growth----------------3.0%----------------------3.5%

25 percentile--------------------2.5%----------------------2.0%

75 percentile--------------------4.0%----------------------5.7%

Maximum Growth---------------4.5%----------------------8.7%

- Overall, higher taxes on the rich historically have correlated to higher economic growth for the country. It's counterintuitive, but it is the historical fact. Just, to be certain, we can compare taxes to job creation also.

Again we see higher growth when the marginal tax on the rich is higher. It might seen odd, but that's what history shows us.

Let's look closer at how the economy changed after tax cuts. We can look at how both GDP and employment grew just before the tax cut, and then just after the tax cut. Did they grow faster or slower?

In the last 50 years there were 5 tax cuts to the rich. Three of them were followed by a decline in GDP growth, 3 were followed by a decline in employment growth. The evidence suggests that tax cuts do not promote growth and probably promote decline.

In the last 50 years there was just one tax increase to the rich. After that tax increase both the GDP and employment growth rates increased significantly.

The historical evidence suggests that an economic decline will follow a tax cut to the rich, and economic growth may follow a tax increase to the rich. The evidence suggests that the optimum tax marginal tax rate on the rich is higher than 60%.

Can we make similar conclusions for taxes rates on the middle class and poor?

For the lower classes, the historical data does not have an apparent pattern. The scatter is wide and fails to show a tendency in either direction.

Historically, taxes on the middle class and poor have shown no correlation to economic growth. Other factors must have greater influence than tax rates.

via conceptualmathematics.org

Last edited:

zeke

Well-known member

http://www.huffingtonpost.com/2012/...14.html?ncid=edlinkusaolp00000003&ir=Politics

Prominent conservative author and Obama critic Dinesh D'Souza has resigned from the from the presidency of The King's College, an evangelical Christian liberal arts school based in Manhattan, the college's board of trustees announced Thursday.

The sudden departure comes after days of controversy over accusations of marital infidelity against D'Souza, who reportedly attended a recent event on Christian values with a woman who was not his his wife of 20 years and shared a hotel room with her. .....

Bleedsblue&white

Well-known member

Let me get this straight. One party basically takes its toys and goes home, offering zero cooperation. Gridlock.

So, the best practical option (i.e. not voting for a third party) is to vote for the candidate of grumpy party, despite his economic policies that are vacuous fantasies and a foreign policy centered on maintaining a creaking oil empire and Kristian end-of-time rabble-rousing.

Gotcha. Makes sense to me!

Kind of ****ed up isn't it?

What's even more ****ed up is the people defending it...even the ones who are trying hard to pretend they aren't. I said it was treason and damn it I'll stand by it.