worm

Well-known member

Is trudope listening?

Don't die now stock market. Recession fears are all the rage again today... No real rotation. Money being pulled out of the market. Hold on till at least November pls.

Oh it's not about that. I'm more concerned about stock market weakness heading into November, which doesn't require a recession to actually occur! Trump has nothing on 'mala right now. The less ammo he has the better.Traders have predicted 38 of the last 2 recessions, so yeah.

Oh it's not about that. I'm more concerned about stock market weakness heading into November, which doesn't require a recession to actually occur! Trump has nothing on 'mala right now. The less ammo he has the better.

Famous last words. Predicting price action in a timeframe as short as this is a dangerous game my friend. There can be a 5-10% consolidation between now and november and the charts would still look healthy and not necessarily be "suffering." But I sure would prefer things to keep booming as they have. People have short memories.Can't see the market suffering in an environment with declining interest rates.

Famous last words. Predicting price action in a timeframe as short as this is a dangerous game my friend. There can be a 5-10% consolidation between now and november and the charts would still look healthy and not necessarily be "suffering." But I sure would prefer things to keep booming as they have. People have short memories.

Absolutely. But again I'm not talking about that. I'm referring to a 3 month stretch of price action. Odds will always favor the bulls but 3 months is a highly variable timeframe. And nothing impacts sentiment more than price action in shortterm timeframes, as irrational as it may be.Meh

View attachment 21464

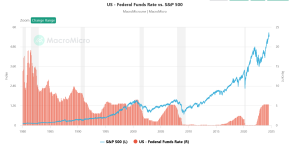

Short of a major market event (dotcom bubble burst, great recession, or covid), the market will react to money supply like it tends to.

Again I already explained why I prefer to not have weakness. Trump is floundering, grasping at straws and he's dying for anything to latch on to. I'd simply prefer if he had nothing.Meh

The market went up ~10% during the Clinton-Trump campaign that nearly everyone in the universe though Clinton was going to win, with a Democrat president. It went up 10% the month before the election in Trump-Biden and Biden whomped Trump anyway. It was dead flat for 2-3 months before Obama beat Romney as the incumbent and Obama won easily.

Hard meh on worrying about the movement of the market before an election.

Meh

The market went up ~10% during the Clinton-Trump campaign that nearly everyone in the universe though Clinton was going to win, with a Democrat president. It went up 10% the month before the election in Trump-Biden and Biden whomped Trump anyway. It was dead flat for 2-3 months before Obama beat Romney as the incumbent and Obama won easily.

Hard meh on worrying about the movement of the market before an election.

Easy for you to say when you have not gambled your life savings on the election

Can't see the market suffering in an environment with declining interest rates.

History says it does initially because the news gets sold

The election isn't being lost because the S&P goes down 3-4 points in September.

No one ever implied that for a secondThe election isn't being lost because the S&P goes down 3-4 points in September.