MindzEye

Wayward Ditch Pig

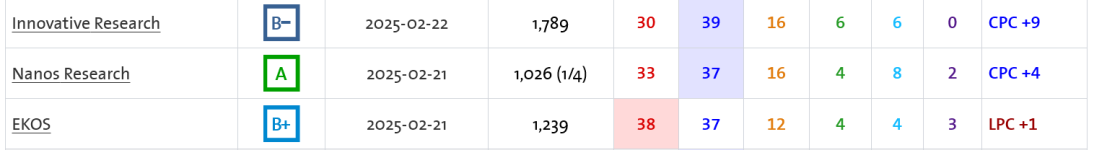

Wanted to bring this up again. It's a wild polling result but Ekos has been ahead of the trend since the Trudeau resignation

They were the first to notice the initial bump:

While everyone else was still pumping out CPC +20 type numbers

They were the first ones by a lot to start calling the race more or less a dead heat when the Carney steam was picking up

The first to call the Liberals ahead while everyone else still has CPC comfortably to massively ahead

Got laughed at by other pollsters when they had the LPC pulling ahead..

and now they're producing LPC +15 results. Which sounds crazy, but Ekos results have been crazy for almost 2 months now until everyone else's results catch up a week or two later.